Join the network

Two ways to connect

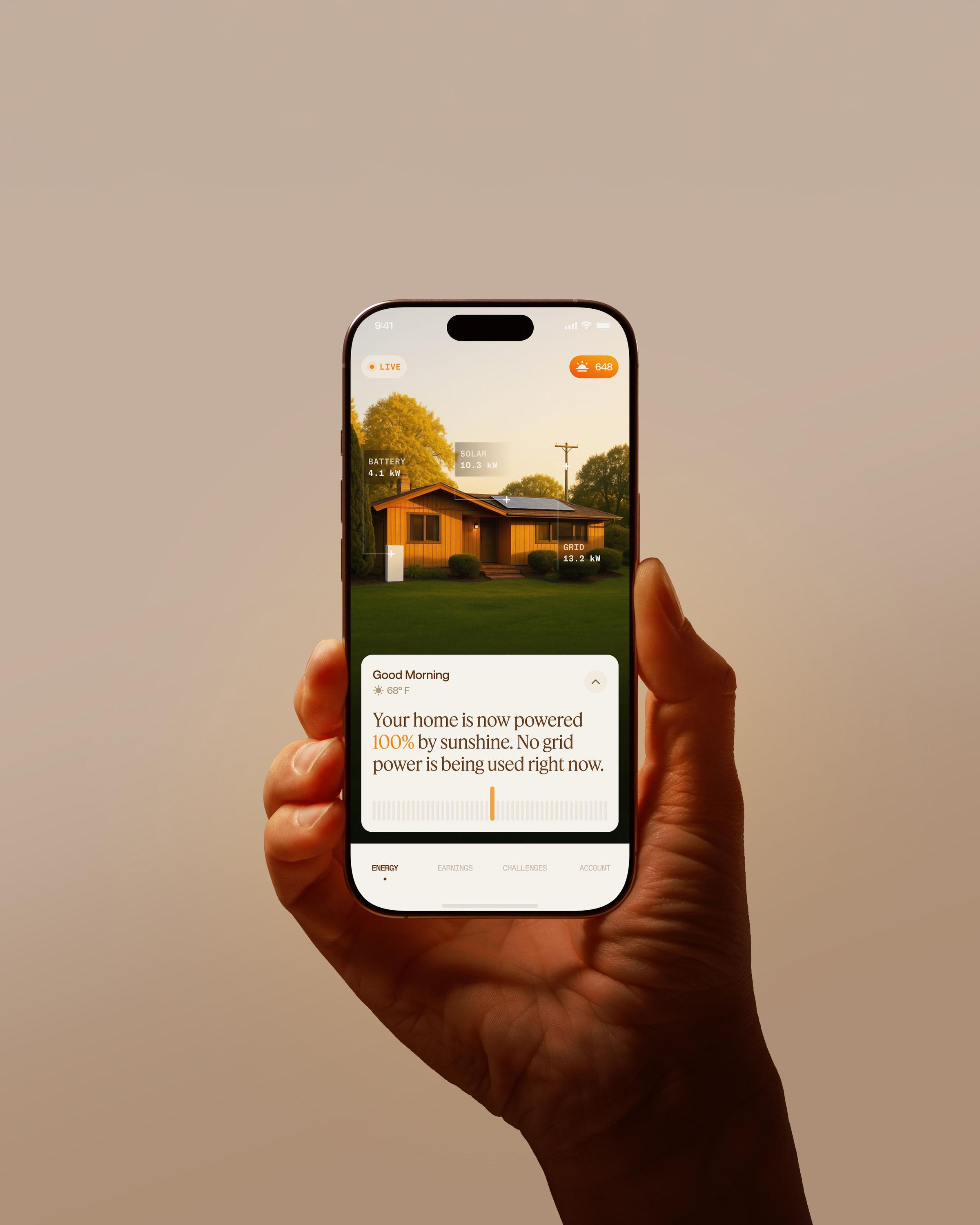

Subscribe to get solar + battery backup with no upfront costs. Daylight owns the system, you pay for the power it produces. Or buy your panels outright and we’ll include a battery at no extra cost to you.

Save on energy. Earn rewards. Stay powered when the grid goes down.

kWh generated

8.2kWh - 9.5kWh

Backup stored

68°F

save

protect

Earn

Choose a monthly energy subscription or purchase your system outright. Both options include an oversized backup battery from Daylight at no additional cost. You create enough power for you, and share surplus with the grid.

Subscribe to get solar + battery backup with no upfront costs. Daylight owns the system, you pay for the power it produces. Or buy your panels outright and we’ll include a battery at no extra cost to you.

With solar and battery installed, your house produces clean energy and stores surplus.

Excess energy is traded with the grid through your battery. You stay powered during outages and earn rewards just by being part of the network.

Today's grid was built for yesterday's world

Electricity costs are skyrocketingBlackouts are 10X more common than in 1980More than 50% of U.S. homes are at risk of outages

Daylight is creating the power we all need by building the world’s largest decentralized energy network

Daylight rewards the people that power it. Earn Sun Points for gift cards, merch, or to pay your Daylight subscription.

Ready to take control of your power? It’s time to step out of the past, and into a more resilient, rewarding energy future.